Sales Representatives

Stop procrastinating and get paid easily

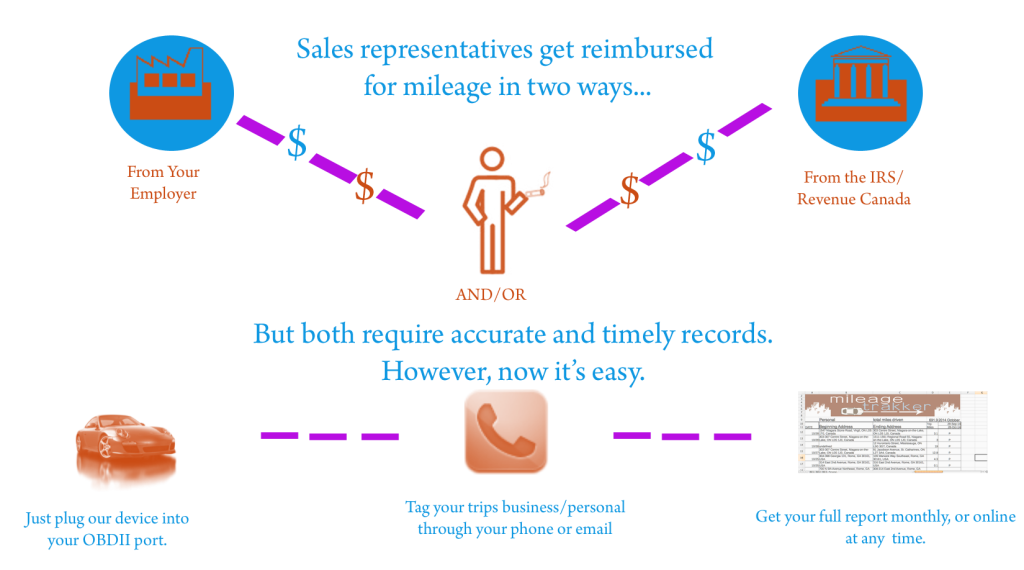

No matter if you are reimbursed or claiming your own mileage, you are likely leaving money on the table!

If your employer reimburses you:

We find that an average sales rep spends 80 hours a year on tracking their mileage.

If you’re on commission, that’s time for another sale.

You often record off-company time, which means it could be more time to spend on yourself.

Sound Familiar?

How much is an extra sale worth to you?

Also, a lot of times you miss trips you could have claimed because you didn’t have time at the time to record it and it never ended up in your calendar (ie. the day you were asked at the last minute to drive a client to the airport)

Let’s get the numbers right!

(and let us do all your paperwork).

No getting behind with your mileage expense reports. Just collect money every month.

If you claim your mileage on your taxes:

The IRS is offering $0.67/mi in 2024. Revenue Canada is offering $0.70 for the 1st 5,000 km and $0.64/km thereafter. Most sales reps will travel 12,000 miles/19,000 km or more in a year.

This is approximately $8040 USD or $12,460 Cdn in deductions every year.

You can only claim these deductions with a beginning and ending location, mileage and a purpose for all trips.

It’s time consuming to write down every trip or subtract out trips from other vehicles that were tracked by an app or look up trips on a map site.

Sound Familiar?

Mix of Both

Did you know that if your employer doesn’t reimburse at the government standard mileage rate, in some cases, you can claim them on your taxes?

(not available in the US, but check your options in Canada)

Get reports that will satisfy both your employer and the Revenue Canada without the headache of constantly recording individual trips by hand.

Also, if you run your own business on the side (ie. drive for delivery as an independent driver or you do a woodworking business on the side ) , you will be able to write those miles off on your taxes. Mileage Trakker can trakk all miles and separate them out into separate businesses so you can get reimbursed by your employer and write your additional independent business miles off on your taxes!

Are you ready yet?

In all of these cases Mileage Trakker can help you stop wasting time and get paid quickly.

See Pricing Options

Please consult with your accountant/tax preparer to determine exactly what you and/or your company is allowed to write off for mileage.