Sales Reps… Are You Being Robbed?

W2 Sales Reps: You are out on the road, day after day, lining up those sales for your company. Your car is full of Starbucks cups and drive through food wrappings. You feel like you live in your car –and you certainly are racking up the miles. Are you getting your proper reimbursement, though?

Did you know the government is offering 57.5 cents/mile in 2015? Is your employer reimbursing you at this rate? Probably not. In recent years, a lot of companies are giving a reduced reimbursement rate OR just giving you a set amount of money per month. How does that equate to what the government would reimburse?

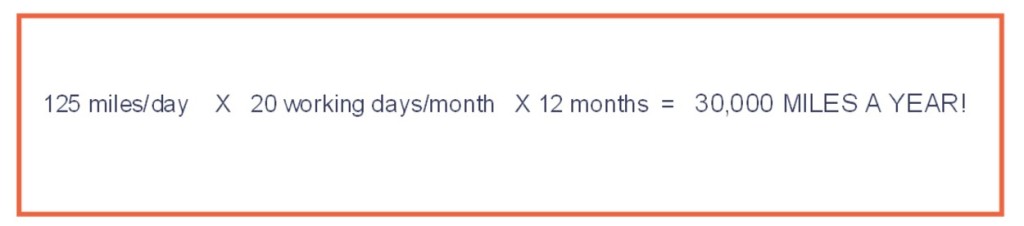

Recently, I met an alarm company sales rep. He told me he drove approx. 125 miles/day. His company, however, was only giving him $200/month.

LET’S DO THE MATH:

At the government reimbursement rate of 0.575 cents/mile this would be a

$17,500 deduction.

Using his company’s reimbursement rate, he is

getting only $2,400.

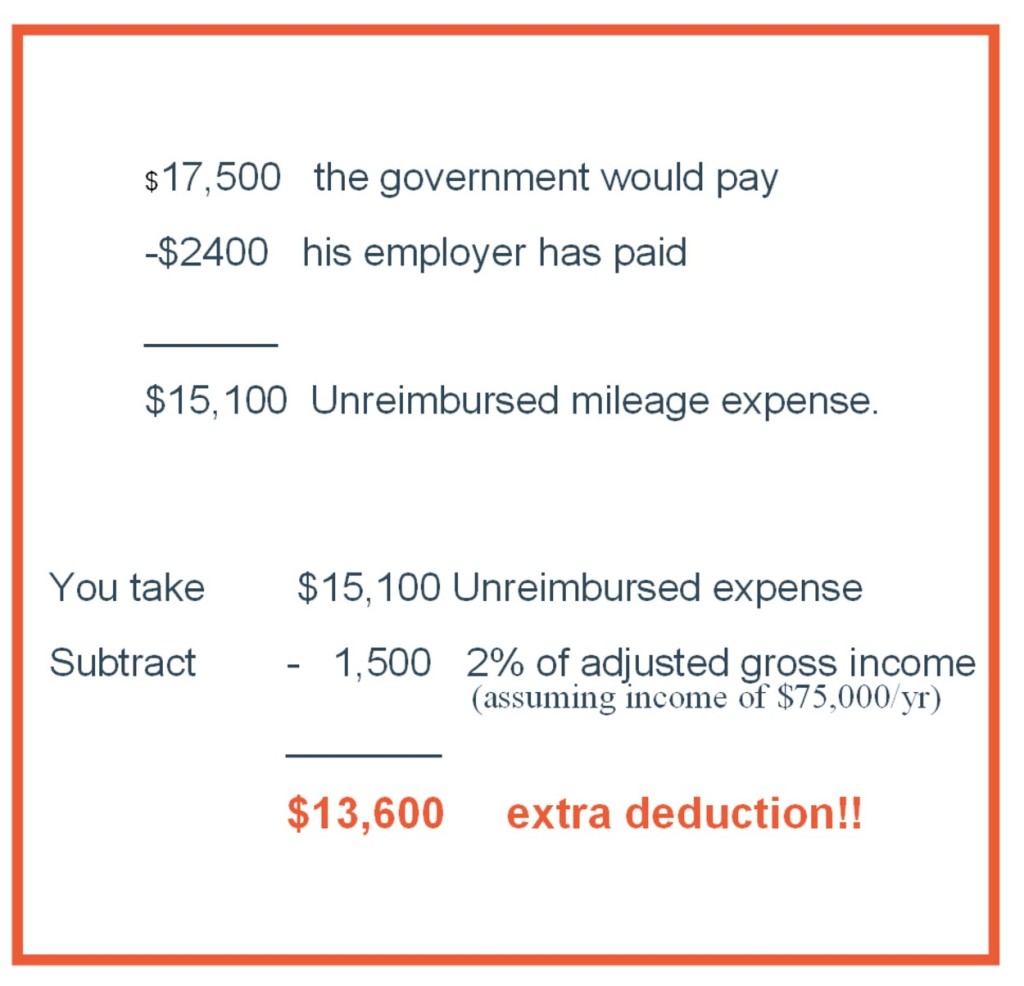

HE IS GETTING ROBBED !

THE GOOD NEWS! THERE IS SOMETHING CALLED UNREIMBURSED BUSINESS EXPENSE!

Business mileage can be claimed in this category. Here’s how it works. My alarm salesman above would take the amount the government would pay, subtract what he is receiving from his employer. Next there is a rule that says he must deduct 2% of his income. The remainder is his unreimbursed business expense:

(Unfortunately, Canadian reps– this does not apply to you.)

At the 25% Fed Tax Bracket:

that will put an extra $3400 in our alarm salesman’s pocket!!

Yep, he was getting robbed — though he was robbing himself! Are you?

Well, you and your employer can still be friends. Just make sure you are taking your Unreimbursed Mileage Deduction

PLEASE NOTE: To get this deduction you need a detailed mileage log – providing date, starting and ending locations, starting and ending odometer readings, the number of miles travelled and A DETAILED purpose for each business trip.

That’s where we come in… we make it simple to have the records you need to get that extra $3400 in your pocket. The Mileage Trakker automatically tracks every trip you take. You tag them business or personal, we add the tags in and deliver to your inbox reports with all the right details to “nail down” your unreimbursed mileage expense. It’s that EASY.

To register for your device:

https://www.mileagetrakker.net/signup

More on how it works:

http://mileagetrakker.com/what-we-are/

Benefits for Independent Business Owners:

http://mileagetrakker.com/independent-business-owners/

Questions: Call: 706-237-6789

To register for your device:

https://www.mileagetrakker.net/signup

More on how it works:

http://mileagetrakker.com/what-we-are/

Benefits for Independent Business Owners:

http://mileagetrakker.com/independent-business-owners/

Questions: Call: 706-237-6789

MILEAGE TRAKKER…. Your new best friend.

We’re keeping trakk, while you’re making trakks…

* Always check with your accountant or tax professional to determine which deductions apply to you.