Great news for Mileage Trakkers! Both the IRS and Revenue Canada have increased the standard mileage rate for 2019!! That’s more money in your pocket. Check out the rates of both the US and Canada below: The IRS has raised the standard mileage rate for 2019 from $0.545 cents/mile to $0.58 cents/mile! That’s a significant […]

“It’s down to the wire…. to get those corporate taxes done. Mileage, you remember from last year could be your biggest deduction. You run out to your car…only to find yourself in… You know you had it tucked in the side pocket of the driver’s door. You know you did write down some mileage […]

Agents: You work hard for your clients – helping them obtain the best price for the home they are selling and/or helping them find the RIGHT new home for them to buy. You invest a lot of time, drive a lot of miles and invest a lot of money. Wouldn’t it be great if, while […]

MEET ELLEN HILL A realtor with Berkshire Hathaway East Cobb in Marietta, GA, Ellen went into real estate two years ago after having been an interior decorator. This is a great benefit to her real estate clients as she can help them showcase their home to its best advantage. She also works hard for […]

GUEST POST BY: G. SPILLER – http://theleaninnovator.net The first long distance communication link was actually digital. The telegraph replaced flags, smoke signals and mirrors as the first reliable long distance link. My dad’s best friend was a HAM radio enthusiast who worked for NASA. As a young child, I remember watching a teletypewriter […]

W2 Sales Reps: You are out on the road, day after day, lining up those sales for your company. Your car is full of Starbucks cups and drive through food wrappings. You feel like you live in your car –and you certainly are racking up the miles. Are you getting your proper reimbursement, though? Did […]

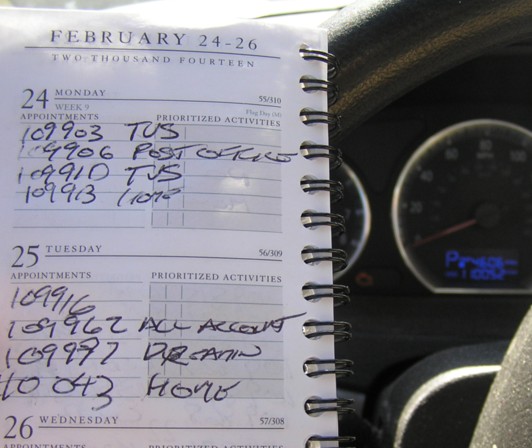

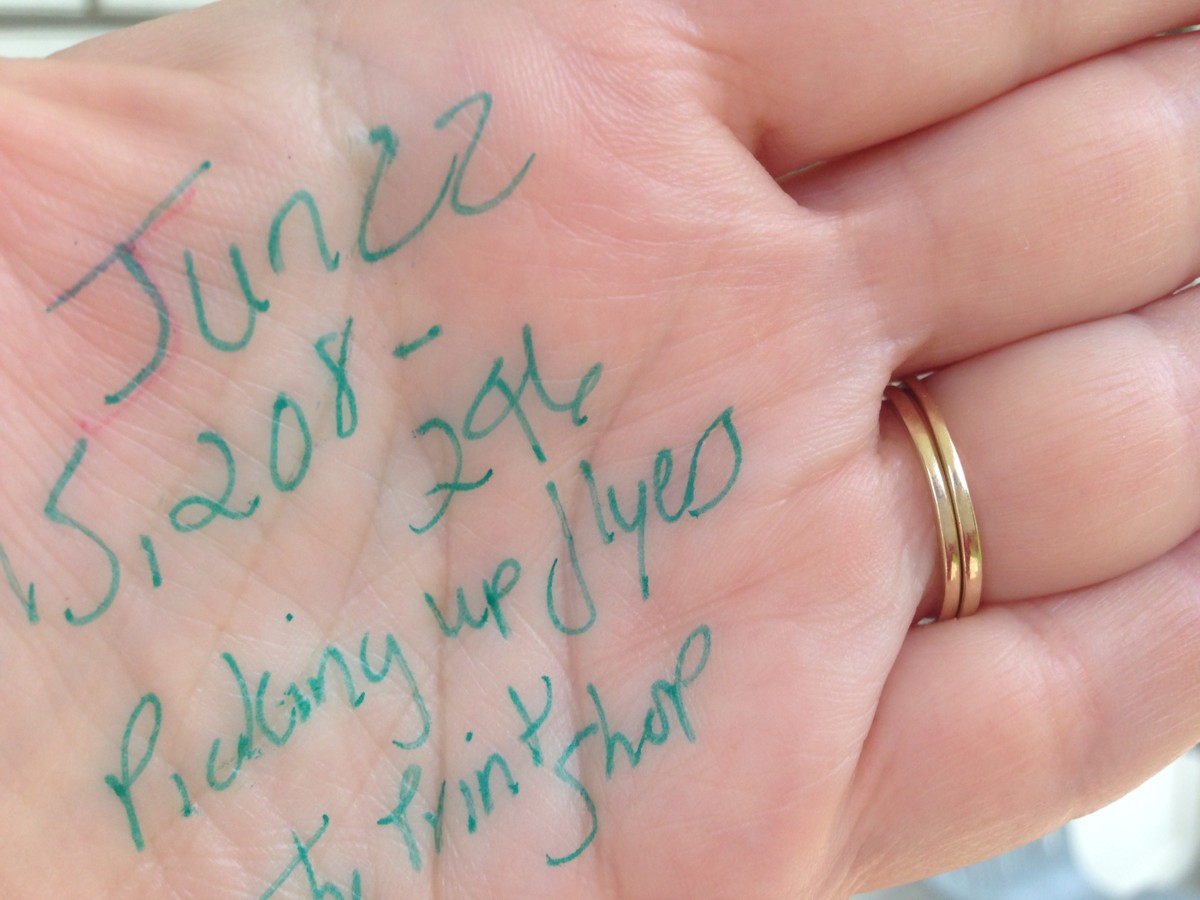

When I am out meeting independent business owners or 1099 (independent) sales reps, I always ask “How do you keep track of your mileage?” Specifically, I am enquiring of those people who are using their personal vehicle and are planning on taking the standard mileage deduction. Of course there are the more common answers: the […]

When will your city burn theirs?

For those of you who need to conserve cash at the moment but still want the benefits of Mileage Trakker, why not lease the device? How it works In the U.S. you pay $99.95 (plus tax) up front, then you pay $35/month for one year. ( you must commit to one year when you sign up.) Mileage […]

Recent Comments